Your cart is currently empty!

Tag: Economics

-

Unraveling the Consumer Price Index: How it Shapes the Economy and Stocks

In the world of economics, few indicators carry as much weight as the Consumer Price Index (CPI). This key measure not only tracks inflation but also has a significant impact on economic policies and investment strategies. In this blog post, we’ll dive into what the CPI is all about and explore how it affects both…

-

Wallets Feel the Pinch: Inflation Stays Hot in January

As we ventured into 2024, many hoped for a break from the financial strains of the past year. Yet, January has swiftly reminded us that inflation remains a resilient force, continuing to challenge households across the nation. The price increases affecting everyday expenses—from groceries to utilities—underscore a period of economic adjustment that demands our attention…

-

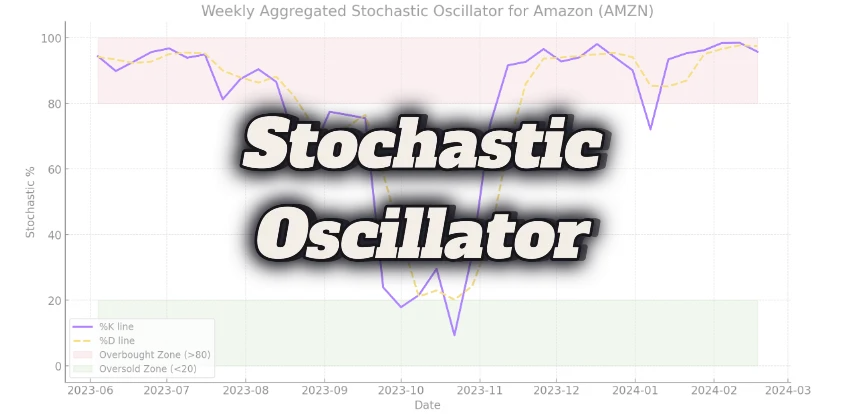

The Stochastic Oscillator: Enhancing Your Trading Strategy with Real-World Examples

The Stochastic Oscillator is a powerful momentum indicator in the arsenal of a stock trader, designed to highlight overbought and oversold conditions in the market. This guide will deepen your understanding of how to use the Stochastic Oscillator effectively, enriched with real-world scenarios and examples to demonstrate its practical application, particularly focusing on Amazon (AMZN)…

-

Fibonacci Retracements: A Hidden Pattern in Options Trading

Picture a stock price moving like a wave on the ocean. It doesn’t just move in a straight line – there are rises and falls, peaks and valleys. Fibonacci retracement is a technical analysis tool that attempts to predict where prices might find support (a stopping point during a drop) or resistance (a stopping point…

-

The Link Between Unemployment Rates and Stock Prices

The unemployment rate serves as a crucial barometer for gauging the economic health of a nation. High unemployment can signal economic challenges, impacting purchasing power, productivity, and the well-being of the workforce. On the flip side, a low unemployment rate suggests a thriving economy, influencing investor confidence and stock market activity. Unemployment Rate’s Impact on…

-

Navigating the Financial Seas: U.S. Treasuries Find Calm Waters as Storm Brews in China’s Economy

In the dynamic world of finance, understanding the ebb and flow of markets can be a complex endeavor. However, breaking down recent events into simpler terms can help us grasp the essentials. A key point of interest in the latest market developments revolves around U.S. Treasury bonds and the economic situation in China. Understanding Treasuries…

-

Navigating Investments: Roth IRA, Traditional IRA, and ETFs

Investing can feel like a daunting climb up Mount Everest, especially with all the jargon and complex options. Planning for the future involves making smart choices about where you put your money. Let’s take a simple look at three popular ways to invest: Roth IRA, Traditional IRA, and Exchange-Traded Funds (ETFs). 1. Roth IRA: Tax-Free…

-

Cracking the Code: A Beginner Guide to Stock Market Indicators

Investing in the stock market can be exciting, but it can also feel like navigating a dense jungle. Whether you’re a seasoned investor or a newbie exploring the financial landscape, understanding these indicators can pave the way to smarter investment decisions. In this guide, we’ll break down some essential indicators in a simplified manner to…

-

A Silver Lining in the Economy: Inflation Eases and Wages Climb

Good news, everyone! There’s a bit of a bright spot on the economic horizon for Americans, and it’s worth talking about. After a period where it felt like every trip to the store or gas station was a wallet-draining experience, things are starting to look up. Inflation, our not-so-favorite trend of rising prices, is showing…

-

Understanding the Dance of Economics and Stocks: A Guide for Investors

Understanding the Dance of Economics and Stocks: A Guide for Investors Introduction Hey there, fellow investors and curious minds! Today, let’s dive into a topic that’s crucial yet often overlooked in the stock market world – the powerful influence of economics. You know, understanding stocks isn’t just about company reports and market trends; it’s also…